Why Submitting an Online Tax Return in Australia Is the Fastest Way to Get Your Refund

Why Submitting an Online Tax Return in Australia Is the Fastest Way to Get Your Refund

Blog Article

Navigate Your Online Tax Obligation Return in Australia: Crucial Resources and Tips

Navigating the online tax obligation return procedure in Australia needs a clear understanding of your responsibilities and the sources readily available to enhance the experience. Essential files, such as your Tax Documents Number and revenue declarations, should be carefully prepared. Selecting a suitable online system can substantially influence the performance of your declaring process.

Comprehending Tax Obligation Obligations

Understanding tax obligation obligations is crucial for individuals and companies operating in Australia. The Australian taxes system is controlled by various legislations and laws that require taxpayers to be knowledgeable about their responsibilities. People must report their revenue accurately, which consists of wages, rental income, and investment revenues, and pay taxes as necessary. In addition, homeowners need to comprehend the difference between non-taxable and taxable income to make sure compliance and optimize tax end results.

For businesses, tax obligation commitments include several facets, consisting of the Product and Services Tax Obligation (GST), firm tax, and payroll tax obligation. It is vital for companies to sign up for an Australian Company Number (ABN) and, if appropriate, GST enrollment. These duties require careful record-keeping and prompt entries of tax returns.

Furthermore, taxpayers need to know with readily available reductions and offsets that can relieve their tax obligation concern. Looking for guidance from tax professionals can give important understandings right into optimizing tax placements while guaranteeing compliance with the legislation. Overall, a comprehensive understanding of tax obligation commitments is important for effective financial preparation and to stay clear of penalties associated with non-compliance in Australia.

Necessary Papers to Prepare

Additionally, compile any kind of relevant bank declarations that show interest income, along with dividend declarations if you hold shares. If you have other sources of income, such as rental residential properties or freelance job, guarantee you have records of these revenues and any connected costs.

Think about any kind of private health and wellness insurance statements, as these can influence your tax obligation commitments. By collecting these essential papers in development, you will simplify your online tax obligation return process, minimize errors, and maximize prospective reimbursements.

Choosing the Right Online System

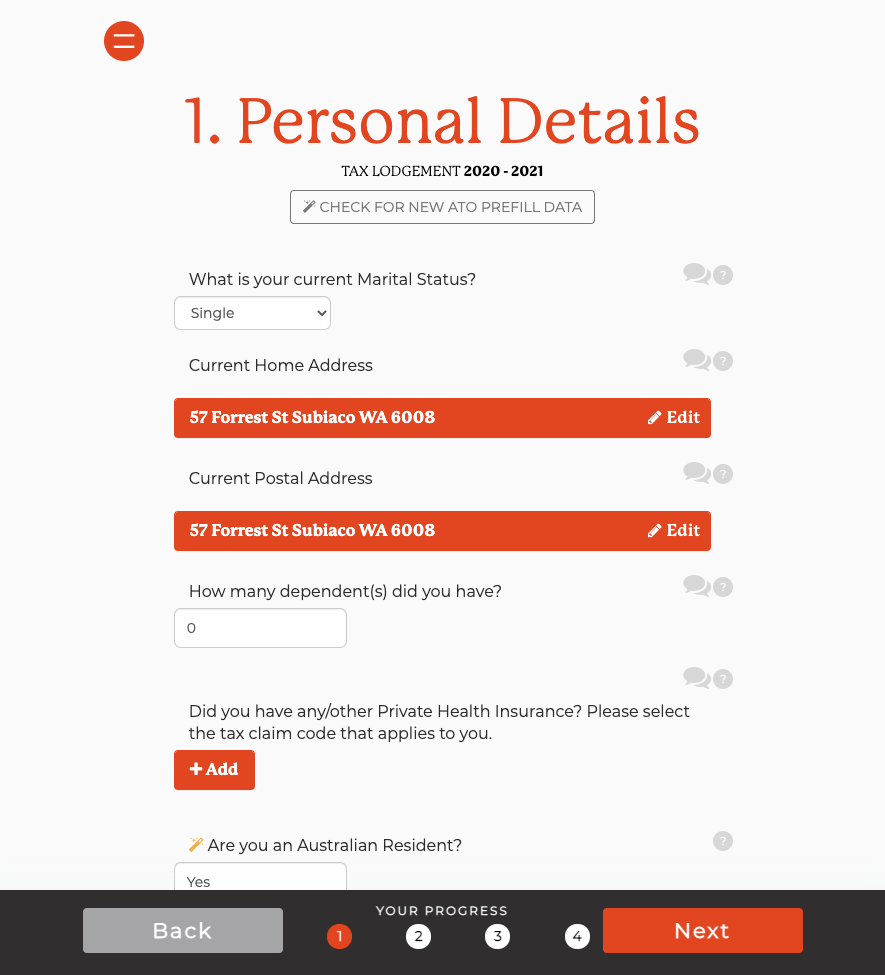

As you prepare to file your on-line tax obligation return in Australia, selecting the ideal platform is important to guarantee precision and simplicity of usage. A simple, user-friendly style can dramatically boost your experience, making it simpler to navigate intricate tax obligation types.

Following, examine the platform's compatibility with your economic situation. Some solutions cater especially to individuals with straightforward tax returns, while others offer comprehensive assistance for much more intricate circumstances, such as self-employment or investment income. Look for platforms that offer real-time error monitoring and advice, assisting to minimize errors and guaranteeing conformity with Australian tax regulations.

An additional crucial element to think about is the level of client assistance readily available. Dependable systems ought to give accessibility to support using phone, e-mail, or chat, particularly throughout optimal filing periods. In addition, research study individual testimonials and rankings to gauge the general satisfaction and integrity of the platform.

Tips for a Smooth Declaring Refine

If you follow a few crucial suggestions to guarantee effectiveness and accuracy,Filing your on the internet tax return can be a straightforward procedure - online tax return in Australia. First, collect all needed files prior to starting. This includes your revenue statements, receipts for reductions, and any other relevant paperwork. Having every little thing at hand decreases disturbances and errors.

Following, make use of the pre-filling function provided by several online systems. This can save time and reduce the possibility of blunders by automatically populating your return with information from previous years and data supplied by your employer and banks.

In addition, confirm all entries for accuracy. online tax return in Australia. Mistakes can result in delayed reimbursements or problems with the Australian Taxation Workplace (ATO) Make certain that your individual details, earnings numbers, and reductions are proper

Be mindful of due dates. Filing early not only decreases stress and anxiety yet also permits much better preparation if you owe taxes. Ultimately, if you have inquiries or unpredictabilities, speak with the assistance sections of your picked system or look for expert recommendations. By complying with these suggestions, you can browse the on-line tax return procedure smoothly and with confidence.

Resources for Support and Assistance

Browsing the intricacies of on the Go Here internet tax obligation returns can often be difficult, but a range of sources for assistance and assistance are conveniently offered to help taxpayers. The Australian Taxation Office (ATO) is the main resource of details, using extensive overviews on its website, consisting of FAQs, educational videos, and live conversation options for real-time help.

In Addition, the ATO's phone support line is available for those who favor direct interaction. online tax return in Australia. Tax obligation specialists, such as registered tax obligation representatives, can additionally offer customized advice and ensure conformity with present tax obligation regulations

Final Thought

In final thought, efficiently navigating the online income tax return procedure in Australia needs a thorough understanding of tax responsibilities, careful prep work of necessary files, and careful choice of an appropriate online system. Abiding by sensible tips can enhance the filing experience, while offered resources provide useful help. By coming close to the procedure with persistance and interest to information, taxpayers can ensure conformity and take full advantage of prospective benefits, ultimately adding to a much more reliable and effective income tax return end result.

As you prepare to submit your on-line tax return in Australia, selecting the right platform is essential to make sure accuracy and ease of use.In conclusion, successfully navigating the on-line tax obligation return procedure in Australia needs a complete understanding of tax obligation obligations, thorough prep work of necessary records, and careful online tax return in Australia selection of a here proper online system.

Report this page